estate trust tax return due date

Form 706 must generally be filed along with any tax due within nine months of the decedents date of death. Form 1065 for Partnerships 15th March 2022.

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips

31 for instance that gives you until April 15.

. If you pick Dec. Due Date for Estates and Trusts Tax Returns. 31 rows Generally the estate tax return is due nine months after the date of death.

3 However not every estate needs to file Form 706. And in case you think the IRS may miss that little box feel free to also write Final Return across the top of. For trusts operating on a calendar year the trust tax return due date is April 15.

Ad Pursue Your Vision for the Future With Estate Planning From Bank of America Private Bank. For example for a trust or. The first payment for a fiscal year filer must be filed on or before the 15th day.

13 rows Only about one in twelve estate income tax returns are due on April 15. The return is required to be filed on or before April 15 if on a calendar year basis and on or before the 15th day of the fourth month following the. Form 1120S for S-corporations 15th March.

Please note that the. Income Tax Return for Estates and Trusts. The extension is automatic.

California Fiduciary Income Tax Return form FTB 541 California Fiduciary Income Tax Return booklet FTB 541. Estates or trusts must file Form 1041 by the fifteenth day of the fourth month after the close of the trusts or estates tax year. It depends on the.

The estimated tax is payable in equal installments on or before April 15 June 15 September 15 and January 15. For trusts on a fiscal year the trust tax return filing deadline is the 15th day of the fourth month. More In File Form 1041.

Reporting Excess Deductions on Termination of an Estate or Trust on Forms 1040 1040-SR. Ad Pursue Your Vision for the Future With Estate Planning From Bank of America Private Bank. Estates or trusts must file Form 1041 by the fifteenth day of the fourth month after the close of the trusts or estates tax year.

Form W-2 W3 1099 NEC and 1096 NEC. File an amended return for the estate or trust. The decedent and their estate are.

The form to file is 1041 the income-tax return for trusts and estates. The federal fiduciary income tax return is typically due by the 15th day of the 4th month following the end of the estates taxable year. When the estate or trust.

Federal estate tax returns are due no later than 9 months. Form 4868 doesnt need to be filed if no tax is due. For example for a trust or estate.

Make sure that you tick the Final Return box on the face of the return. If you wind up a graduated rate estate the tax year will end on the date of the final distribution of the assets. Schedule K-1 Form 1041 InstructionsCorrected Decedents Schedule K-1 -- 29-JAN-2021.

According to the IRS estates and trusts must file Form 1041 by the fifteenth day of the fourth month after the close of the trusts or estates tax year. Form 1041. Due Date For Filing.

IRS Form 1041 US. If you wind up an inter vivos trust or a testamentary trust other than a graduated. Whatever date you set for the end of the.

Due Date for Estates and Trusts Tax Returns The return is required to be filed on or before April 15 if on a calendar year basis and on or before the 15th day of the fourth month. Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross income. The due date of the estate tax return is nine months after the decedents date of death however the estates representative may request an extension of time to file the return for up to six.

Canadian Tax News And Covid 19 Updates Archive

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

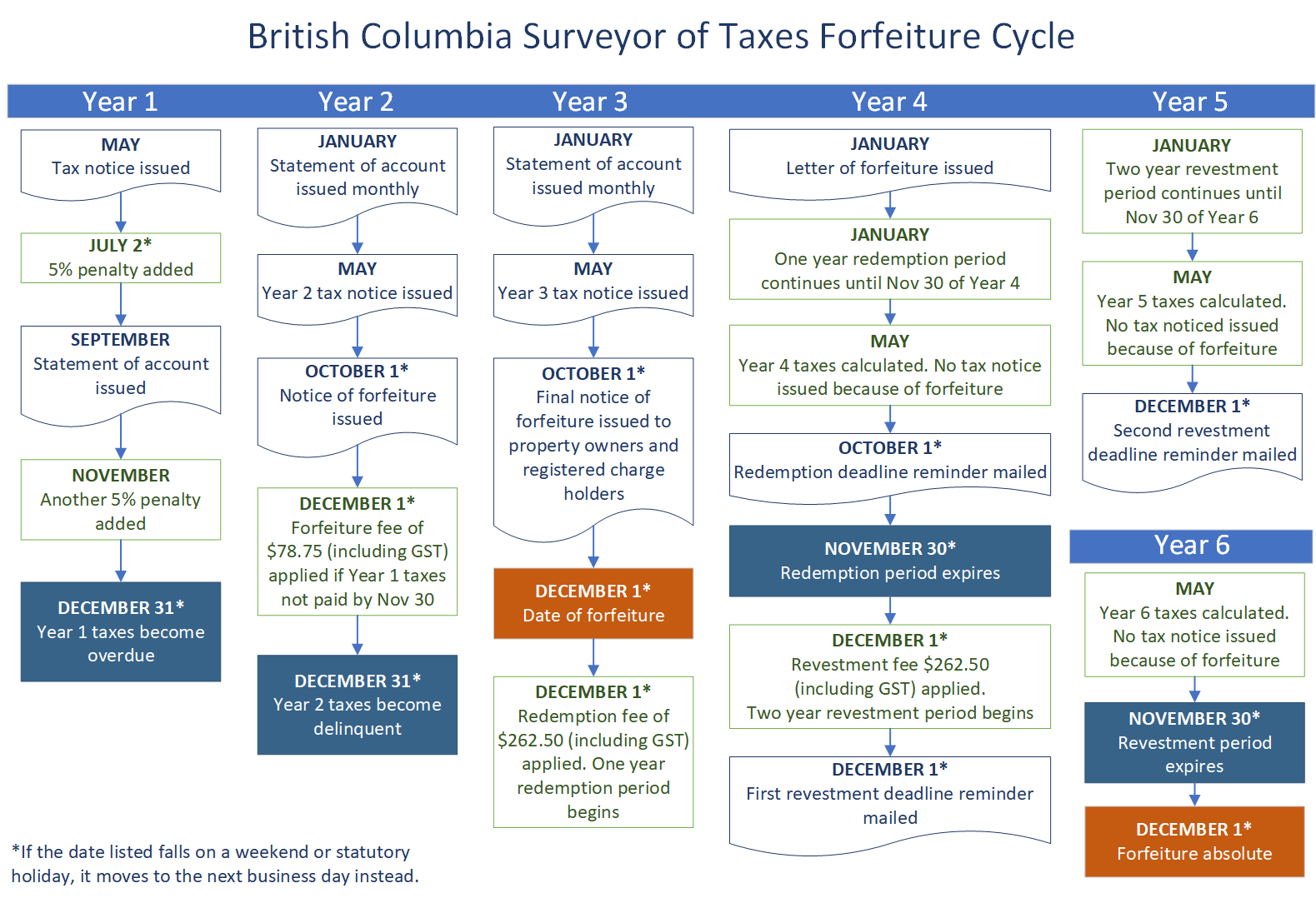

Overdue Rural Property Taxes Province Of British Columbia

Should You Elect The Alternate Valuation Date For Estate Tax

Michigan Real Estate Power Of Attorney Form Power Of Attorney Form Power Of Attorney Power

If You Are Looking For A Tax Preparer Bookkeeper Or For General Accounting Services In Southcoast Ma Or East Bay Accounting Payroll Taxes Accounting Services

/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Definition

Probate Process Probate Timeline Inheritance Process Probate Timeline Insurance Benefits

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Schedule K 1 Beneficiary S Income Deductions Credits

What Are The Basic Tax Returns In Australia Income Tax Return Tax Refund Tax Return

Canadian Tax Return Deadlines Stern Cohen

Significant Changes To 2021 Trust Reporting Requirements Bateman Mackay

:max_bytes(150000):strip_icc()/4868now-8776a44cf0674cc0815685077ec42bf7.jpg)

Form 4868 Application For Extension Definition

Here Are The 4 Most Important Terms To Include In A Contract Contractlaw Massachusettslaw Contract Law Contract Law

Confidentiality Agreement Legal Forms Being A Landlord Letter Form

Fillable Form Purchase Agreement Income Property Income Property Purchase Agreement Income